What is Brookfield Asset Management’s approach to sustainable and responsible investing?

Introduction

In this blog post, we will delve into the approach that Brookfield Asset Management takes to sustainable and responsible investing. As a leading global alternative asset manager, Brookfield Asset Management recognizes the importance of incorporating environmental, social, and governance (ESG) factors into their investment strategy. By doing so, they strive to generate long-term value for their clients while also making a positive impact on society and the environment.

Overview of Brookfield Asset Management

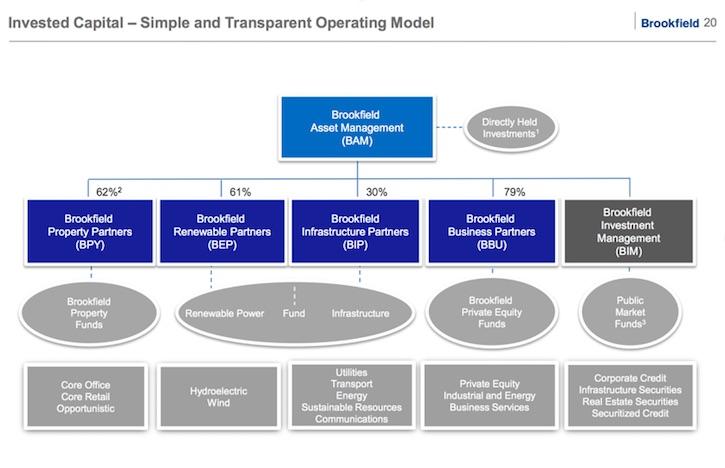

Brookfield Asset Management is a prestigious firm that specializes in real estate, renewable power, infrastructure, and private equity. With over $600 billion in assets under management, they have built a strong reputation for their expertise in alternative investments. Their investment approach is grounded in their commitment to sustainability and responsible investing.

Importance of sustainable and responsible investing

Sustainable and responsible investing has gained significant traction in recent years, as investors recognize the potential impact of ESG factors on financial performance. This approach involves considering environmental, social, and governance factors alongside traditional financial metrics when making investment decisions. By integrating ESG considerations into their investment process, Brookfield Asset Management aims to identify opportunities that align with their clients’ values and have the potential for long-term success.

Sustainable investing is important because it allows investors to contribute to positive social and environmental outcomes. It enables them to support companies that prioritize sustainable practices, such as reducing carbon emissions, promoting diversity and inclusion, and practicing good corporate governance. By investing in these companies, investors can play a role in driving positive change and creating a more sustainable future.

Responsible investing also carries financial benefits. As companies face increasing scrutiny and regulation around ESG issues, those that prioritize sustainability and responsible practices are more likely to be well-positioned for long-term success. This can lead to improved financial performance and lower investment risks. By considering ESG factors, investors can identify companies that are better equipped to navigate these challenges and deliver sustainable returns over time.

Brookfield Asset Management’s approach to sustainable and responsible investing is centered around three key pillars: integration, engagement, and impact.

First, they integrate ESG considerations into their investment process across all asset classes. This involves analyzing ESG risks and opportunities at both the asset and portfolio level. By thoroughly assessing ESG factors, they can identify potential risks that may impact investment performance and uncover opportunities for value creation.

Second, Brookfield actively engages with companies in which they invest to promote responsible practices and long-term sustainable value creation. They collaborate with management teams to encourage disclosure and transparency on ESG issues and provide guidance on best practices. By engaging with companies, Brookfield seeks to drive positive change and help shape more sustainable business practices.

Lastly, Brookfield Asset Management strives to create positive impact through their investments. They seek to invest in assets and businesses that contribute to the transition to a low-carbon economy, address social needs, and promote sustainable development. By investing in renewable energy, sustainable infrastructure, and other impact-focused sectors, they align their investments with their clients’ sustainability goals and contribute to positive societal outcomes.

In conclusion, Brookfield Asset Management’s approach to sustainable and responsible investing emphasizes the integration of ESG considerations, engaging with companies to promote responsible practices, and making positive impact through investments. By incorporating these principles into their investment strategy, they aim to deliver long-term value for their clients while also contributing to positive social and environmental outcomes.

Environmental Considerations

Brookfield’s commitment to environmental sustainability

When it comes to sustainable and responsible investing, one of the key aspects is the consideration of environmental factors. Brookfield Asset Management recognizes the importance of protecting our planet and has made a strong commitment to environmental sustainability.

As a leading global alternative asset manager, Brookfield understands that environmental issues have a significant impact on business operations and financial performance. They believe that integrating environmental considerations into their investment decisions is not only the right thing to do, but also essential for long-term value creation.

Brookfield takes a proactive approach to environmental sustainability by incorporating various strategies throughout their investment process. They focus on minimizing the carbon footprint of their investments, promoting energy efficiency, and supporting the transition to a low-carbon economy.

One of the ways Brookfield demonstrates their commitment to environmental sustainability is through investing in renewable energy projects.

Investing in renewable energy projects

Renewable energy plays a crucial role in mitigating the effects of climate change and reducing greenhouse gas emissions. Brookfield Asset Management recognizes the tremendous potential of renewable energy sources and has made significant investments in this sector.

Brookfield’s investments in renewable energy projects span various technologies, including wind, solar, hydroelectric, and biomass. They actively seek opportunities to invest in projects that contribute to the transition to a cleaner and more sustainable energy future.

By investing in renewable energy, Brookfield aligns their investments with their clients’ sustainability goals. They not only provide clean and renewable energy sources but also actively support the development of these projects.

In addition to their investments, Brookfield utilizes their expertise in infrastructure and real estate to enhance the sustainability of their projects. They prioritize the use of energy-efficient technologies, maximize resource utilization, and implement sustainable practices throughout the lifecycle of their assets.

Furthermore, Brookfield actively engages with the communities in which their renewable energy projects are located. They prioritize community engagement and ensure that their projects have a positive impact on the local economy and environment.

By investing in renewable energy projects, Brookfield not only generates attractive financial returns for their clients but also contributes to the decarbonization of the global energy sector. Their investments in renewable energy projects play a significant role in reducing greenhouse gas emissions, promoting energy independence, and enhancing energy security.

In conclusion, Brookfield Asset Management’s commitment to environmental sustainability is evident through their investments in renewable energy projects. By integrating environmental considerations into their investment decisions and actively supporting the transition to a low-carbon economy, Brookfield demonstrates their dedication to responsible and sustainable investing. Through their efforts, they contribute to positive environmental outcomes while delivering long-term value for their clients.

Social Considerations

Brookfield’s approach to social responsibility

When it comes to sustainable and responsible investing, social considerations are just as important as environmental factors. Brookfield Asset Management understands the significance of social responsibility and incorporates it into their investment approach.

Brookfield recognizes that their investments have the power to make a positive impact on the communities in which they operate. They are committed to promoting social development, fostering inclusivity, and contributing to the well-being of society.

One of the key aspects of Brookfield’s approach to social responsibility is their focus on responsible governance. They prioritize transparency, ethical behavior, and accountability in their business operations. By upholding high standards of governance, they aim to build trust with their stakeholders and ensure the long-term sustainability of their investments.

Furthermore, Brookfield actively engages with the communities in which their projects are located. They believe in building strong relationships with local stakeholders and listening to their feedback and concerns. By involving the community in the decision-making process, Brookfield ensures that their projects have a positive impact on local economies and societies.

Supporting local communities and social initiatives

Brookfield understands the importance of supporting local communities and investing in social initiatives. They believe that their success is closely interlinked with the well-being of the communities they operate in.

One way Brookfield supports local communities is by creating job opportunities. Their investments in various sectors, such as renewable energy and infrastructure, often lead to the creation of employment opportunities. By providing stable and well-paying jobs, Brookfield contributes to economic growth and improves the livelihoods of individuals and families.

In addition to job creation, Brookfield actively supports social initiatives that address pressing societal issues. They invest in projects and programs that promote education, healthcare, and affordable housing. By focusing on these areas, Brookfield aims to enhance social mobility, reduce inequality, and improve the overall quality of life for communities.

Furthermore, Brookfield recognizes the importance of diversity and inclusion in driving social progress. They are committed to fostering a work environment that values diversity, inclusivity, and equal opportunity. By promoting diversity in their own organization and supporting diversity initiatives in the communities they operate in, Brookfield aims to create a more equitable and inclusive society.

In summary, Brookfield Asset Management’s approach to sustainable and responsible investing extends beyond environmental considerations. They also prioritize social responsibility by focusing on responsible governance, supporting local communities, and investing in social initiatives. By integrating social considerations into their investment approach, Brookfield aims to make a positive and lasting impact on society. Through their efforts, they contribute to a more sustainable and inclusive future.

Governance Considerations

Brookfield’s focus on corporate governance

When it comes to sustainable and responsible investing, corporate governance plays a crucial role in ensuring ethical business practices and long-term success. Brookfield Asset Management understands the importance of governance considerations and is committed to upholding high standards in their operations.

Brookfield places a strong emphasis on corporate governance by prioritizing transparency, accountability, and ethical behavior. They believe that by maintaining a robust governance framework, they can build trust with their stakeholders and safeguard the best interests of their investors.

One key aspect of Brookfield’s approach to governance is the establishment of clear policies and procedures. They have implemented comprehensive governance policies that outline the responsibilities of executives, directors, and employees. These policies address various aspects including risk management, conflicts of interest, and compliance with laws and regulations.

To ensure effective oversight and decision-making, Brookfield has a well-structured governance structure in place. They have a board of directors comprising experienced individuals who provide strategic guidance and monitor the management’s performance. The board also includes independent directors who bring an outside perspective and ensure objectivity in decision-making.

Furthermore, Brookfield regularly engages with their shareholders and other stakeholders to gather feedback and address any concerns. They believe in open and transparent communication and provide timely and accurate information about their business and investment activities.

Overall, Brookfield’s focus on corporate governance reflects their commitment to responsible and ethical business practices. By prioritizing transparency, accountability, and best governance practices, they ensure that their operations are conducted in a fair and ethical manner.

Ethical business practices and transparency

Transparency and ethical behavior are integral to Brookfield Asset Management’s approach to sustainable and responsible investing. They understand that by conducting business ethically, they can promote trust, maintain strong relationships with stakeholders, and contribute to the long-term success of their investments.

One of the key pillars of Brookfield’s commitment to ethical business practices is their zero-tolerance policy towards corruption and bribery. They have established a comprehensive Anti-Corruption Policy that applies to all employees, contractors, and partners. This policy outlines their obligations to comply with laws related to bribery, corruption, and money laundering.

In addition to their anti-corruption measures, Brookfield is committed to promoting fair and competitive business practices. They adhere to antitrust and competition laws in all jurisdictions where they operate and ensure that their business activities do not impede fair market competition.

Brookfield also places a strong emphasis on transparency by providing accurate and timely information about their investments and operations. They understand the importance of disclosure and regularly communicate with their investors, providing comprehensive reports and updates on the performance of their investment funds. This transparency helps investors make informed decisions and builds trust in Brookfield’s investment approach.

Moreover, Brookfield believes in conducting thorough due diligence before making any investment decisions. They conduct extensive assessments of potential investments, including evaluating the environmental, social, and governance risks associated with those investments. They also consider the impact of their investments on local communities and work towards minimizing any negative effects.

Overall, Brookfield’s commitment to ethical business practices and transparency is evident in their policies, procedures, and approach to conducting due diligence. By upholding high ethical standards and promoting transparency, they strive to ensure that their investments contribute to sustainable development and create positive outcomes for all stakeholders involved.

Integration of ESG Factors

At Brookfield Asset Management, the approach to sustainable and responsible investing goes beyond financial considerations. The company recognizes the importance of incorporating environmental, social, and governance (ESG) factors into their investment decisions. By integrating ESG factors, Brookfield aims to not only achieve attractive financial returns but also contribute to sustainable development and create positive impacts for society and the environment.

Incorporating environmental, social, and governance factors into investment decisions

When evaluating potential investments, Brookfield takes into account a range of ESG factors. They understand that these factors can have a significant influence on the long-term performance and value of an investment.

Environmental factors include the assessment of a company’s impact on the environment, such as its carbon footprint, resource usage, and waste management practices. Brookfield considers the potential risks and opportunities associated with climate change, energy efficiency, renewable energy, and other environmental issues.

Social factors encompass the evaluation of a company’s impact on its employees, customers, communities, and other stakeholders. Brookfield looks at factors like labor practices, employee health and safety, diversity and inclusion, community relations, and supply chain responsibility. They aim to invest in companies that demonstrate strong social performance and contribute positively to society.

Governance factors pertain to the structure and practices of a company’s governance system. Brookfield pays close attention to issues such as board composition, executive compensation, risk management, and transparency and accountability. They believe that strong corporate governance is essential for sustainable and responsible business practices.

ESG integration strategies at Brookfield Asset Management

To effectively integrate ESG factors into their investment decisions, Brookfield employs several key strategies:

- Systematic assessment: Brookfield conducts comprehensive and systematic ESG assessments for potential investments. This involves analyzing data, conducting due diligence, and evaluating the materiality and relevance of ESG factors for each investment opportunity.

- Engagement with investee companies: Once an investment is made, Brookfield actively engages with investee companies to promote responsible business practices. They work collaboratively with management teams to identify and address ESG risks and opportunities, and drive improvements in ESG performance.

- Monitoring and reporting: Brookfield regularly monitors the ESG performance of their investments and provides transparent reporting to stakeholders. This includes tracking key ESG metrics, reporting on progress, and disclosing material ESG issues to investors.

- Partnerships and collaboration: Brookfield recognizes the importance of collaboration to drive sustainable change. They actively seek partnerships and collaboration opportunities with industry peers, organizations, and stakeholders to address collective ESG challenges and advance responsible investment practices.

By integrating ESG factors into their investment decisions, Brookfield Asset Management strives to generate sustainable value and deliver positive outcomes for their investors, society, and the environment. They believe that by considering these factors, they can mitigate risks, capitalize on opportunities, and contribute to a more sustainable and prosperous future.

In summary, Brookfield Asset Management’s approach to sustainable and responsible investing involves the integration of ESG factors into their investment decisions. By systematically assessing and considering environmental, social, and governance factors, they aim to achieve attractive financial returns while contributing to sustainable development. Through engagement, monitoring, and collaboration, Brookfield seeks to drive responsible business practices and create positive impacts for their investors and stakeholders.