Overview of Brookfield Asset Management

Introduction

In this blog post, we will delve into the world of Brookfield Asset Management – a renowned and influential player in the asset management industry. You might be curious about the history, background, and overview of this company. Well, you’ve come to the right place. Strap in and get ready to explore the fascinating world of Brookfield Asset Management.

Overview of Brookfield Asset Management

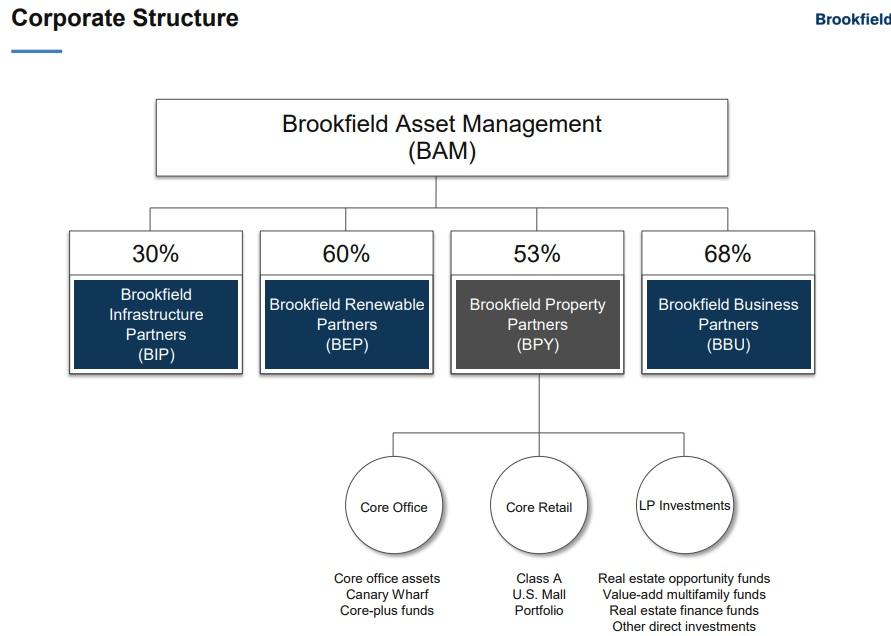

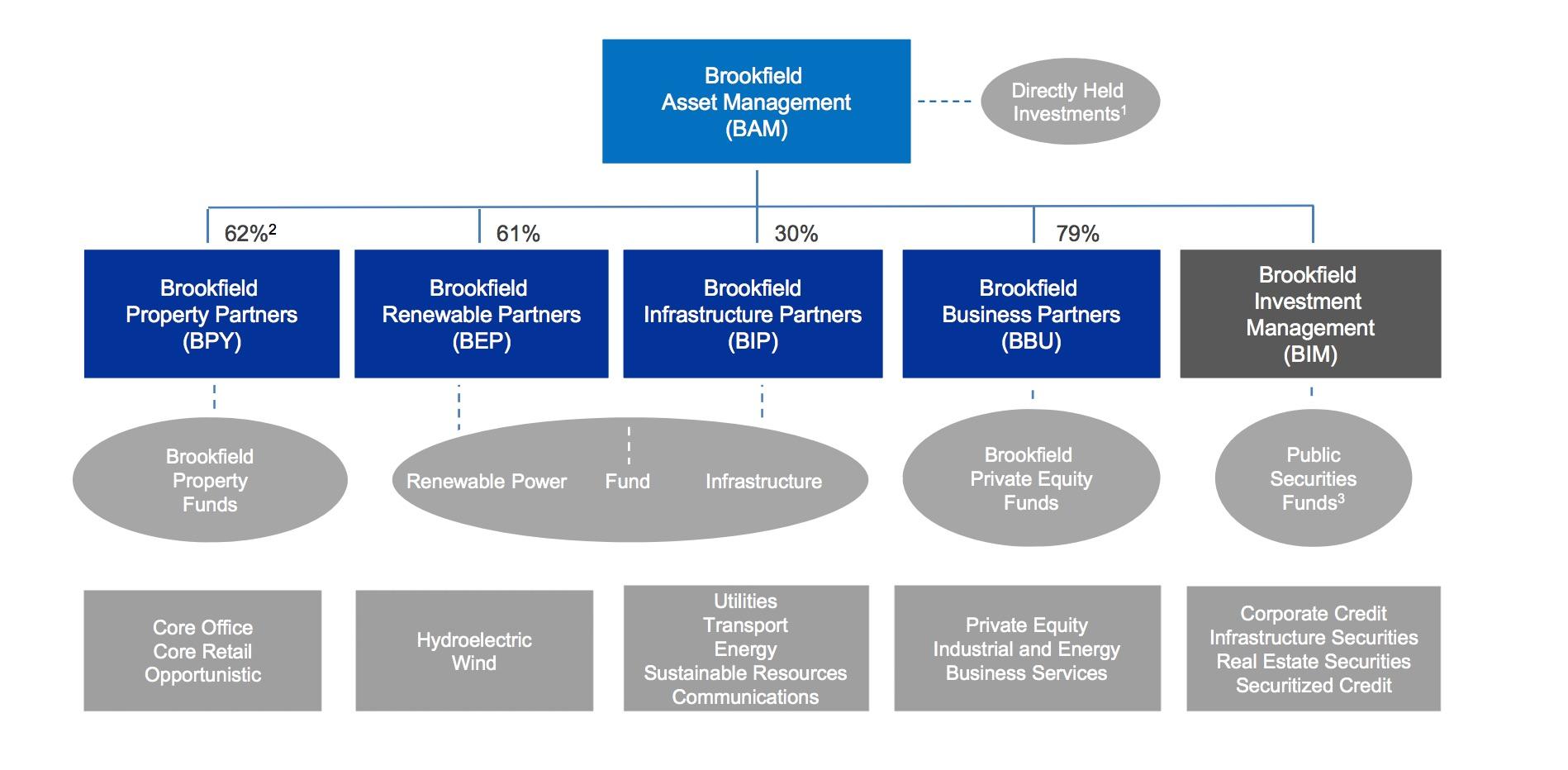

Brookfield Asset Management is a global alternative asset manager, specializing in real estate, renewable power, infrastructure, and private equity. With over 120 years of experience under its belt, the company has built a reputation for delivering exceptional investment returns and managing high-quality assets around the world.

As of 2021, Brookfield manages approximately $600 billion in assets under management (AUM), making it one of the largest alternative asset managers globally. The company operates across North and South America, Europe, Asia, and Australia, providing a wide range of investment solutions to institutional and individual investors.

History and background of Brookfield Asset Management

Brookfield Asset Management was founded in 1899 in Brazil as the São Paulo Tramway, Light, and Power Company by William Mackenzie and Frederick Stark Pearson. Initially focused on providing electricity and public transportation services, the company gradually diversified its operations and expanded into other industries.

In the 20th century, the company underwent several name changes and transformations. It became the Brazilian Traction, Light and Power Company Limited (BTL&P) in the 1920s after acquiring various utility companies. Over the years, BTL&P expanded globally, acquiring assets in Canada, the United States, and other parts of the world.

In the 2000s, BTL&P underwent a significant reorganization and rebranding, adopting the name Brookfield Asset Management. Under its new identity, the company continued to pursue strategic acquisitions and investments, cementing its position as a leader in the alternative asset management industry.

One notable milestone in the company’s history was the acquisition of the Canary Wharf Group in London, England, in 2004. This landmark deal solidified Brookfield Asset Management’s presence in the global real estate market and marked the beginning of its foray into prestigious commercial properties.

Since then, Brookfield Asset Management has continued to expand its portfolio and diversify its investments across various sectors, including real estate, infrastructure, renewable power, and private equity. Today, the company continues to seek out new opportunities, leveraging its extensive experience, global presence, and disciplined investment approach to deliver superior long-term results for its investors.

In Conclusion:

Brookfield Asset Management stands as a testament to the power of strategic vision, adaptability, and relentless pursuit of growth. With a rich history spanning over a century, the company has evolved into a global powerhouse in the asset management industry. Through its diverse portfolio of investments and commitment to delivering superior returns, Brookfield Asset Management has firmly established itself as a trusted partner for investors seeking long-term value and stability.

Key Projects and Investments

Real estate investments by Brookfield Asset Management

Brookfield Asset Management, with its vast experience and expertise, has made significant investments in the real estate sector. The company has a global portfolio of premier commercial properties, residential developments, and retail spaces. These investments not only generate steady income but also offer long-term appreciation potential. Some notable real estate projects managed by Brookfield Asset Management include:

- Canary Wharf, London: This iconic commercial property in London’s financial district was acquired by Brookfield in 2004. The Canary Wharf Estate encompasses more than 16 million square feet of leasable space, including office buildings, retail spaces, and leisure facilities. It has become a hub for global businesses and a symbol of London’s status as a leading international financial center.

- Brookfield Place, New York: Located in the heart of downtown Manhattan, Brookfield Place is a mixed-use complex that includes office spaces, luxury retail boutiques, dining options, and cultural amenities. The project has revitalized the downtown area and has become a premier destination for businesses, residents, and visitors.

- Marina Bay Financial Centre, Singapore: Brookfield Asset Management has a significant presence in Asia, and the Marina Bay Financial Centre is a prime example of its real estate investments in the region. This integrated development comprises three office towers, retail podiums, and residential apartments, offering a vibrant and modern working and living environment.

- Darling Square, Sydney: In Australia, Brookfield Asset Management has invested in the transforming Darling Square precinct. This mixed-use development features residential buildings, commercial offices, retail spaces, and vibrant public spaces. It has become a dynamic urban hub that celebrates the fusion of culture, creativity, and sustainability.

Infrastructure projects managed by Brookfield Asset Management

In addition to its real estate investments, Brookfield Asset Management is actively involved in managing and developing critical infrastructure projects worldwide. These projects are focused on providing essential services and improving the quality of life for communities. Some notable infrastructure projects managed by Brookfield Asset Management include:

- Toll Roads and Bridges: Brookfield Asset Management owns and operates a portfolio of toll roads and bridges, including major transportation arteries in North and South America, Europe, and Australia. These infrastructure assets enhance connectivity, reduce travel times, and contribute to economic growth.

- Renewable Power: The company is a global leader in renewable power generation, with investments in wind, solar, hydroelectric, and biomass energy across different continents. Brookfield’s renewable power assets provide clean and sustainable energy solutions, reducing reliance on fossil fuels and combating climate change.

- Airports and Ports: Brookfield Asset Management has a presence in the airport and port sectors, managing and operating key facilities in North America, Europe, and Asia. These investments support international trade, facilitate travel, and contribute to economic development in the regions they serve.

- Telecommunications Infrastructure: Recognizing the increasing importance of digital connectivity, Brookfield Asset Management has invested in telecommunications infrastructure projects, including fiber-optic networks and data centers. These investments help meet the growing demand for high-speed internet and enable businesses to thrive in the digital age.

Brookfield Asset Management’s diverse range of projects and investments in real estate and infrastructure demonstrate its commitment to creating long-term value and enhancing communities. The company’s strategic approach, combined with its global reach and extensive industry knowledge, positions it as a trusted partner for investors seeking stable returns and sustainable growth in the ever-changing world of assets and investments.

Investment Strategies

Overview of Brookfield Asset Management’s investment approach

When it comes to investment strategies, Brookfield Asset Management stands out as a leader in the industry. With its expertise and experience, the company adopts a unique approach that sets it apart from its competitors.

Brookfield Asset Management believes in the power of long-term thinking and focuses on assets with attractive risk-reward profiles. The company has a global perspective, investing across a wide range of sectors and geographies to diversify its portfolio and capture value in different market conditions.

One key aspect of Brookfield’s investment approach is its focus on real assets. Real assets provide a tangible and reliable source of value, such as real estate, infrastructure, renewable power, and natural resources. By investing in these assets, Brookfield aims to generate steady cash flows, provide stable returns, and create long-term value for its investors.

Analysis of Brookfield Asset Management’s investment management strategies

Brookfield Asset Management’s investment management strategies are characterized by their disciplined and opportunistic approach. The company carefully evaluates investment opportunities, considering both macroeconomic trends and specific asset-level factors.

One of Brookfield’s key strengths is its ability to identify undervalued assets and turn them into profitable investments. The company combines its deep industry knowledge with rigorous analysis to uncover hidden value and implement value creation strategies. This may involve operational improvements, asset redevelopment, or strategic positioning to maximize the potential of the investment.

Another important aspect of Brookfield’s investment management strategies is its focus on sustainability. The company recognizes the importance of environmental, social, and governance (ESG) factors in investment decision-making. By integrating ESG considerations into its investment process, Brookfield aims to generate positive social and environmental outcomes while delivering attractive financial returns.

Additionally, Brookfield Asset Management’s investment management strategies are characterized by a long-term horizon. The company takes a patient approach, allowing it to capture value over extended periods. This long-term perspective enables Brookfield to navigate market cycles and seize opportunities that may not be immediately apparent to others.

Furthermore, Brookfield’s investment management strategies are supported by its operational expertise and hands-on approach. The company has a team of industry experts who actively manage its investments, leveraging their deep knowledge and experience to enhance asset performance. This active management approach allows Brookfield to create value throughout the investment lifecycle, from acquisition to divestment.

In conclusion, Brookfield Asset Management’s investment strategies reflect its commitment to creating long-term value and delivering attractive returns to its investors. Through its disciplined and opportunistic approach, the company identifies undervalued assets, implements value creation strategies, and maintains a focus on sustainability. Supported by its operational expertise and long-term horizon, Brookfield continues to be a trusted partner for investors seeking stable and sustainable growth in the ever-changing world of assets and investments.

Financial Performance

Review of Brookfield Asset Management’s financials and key ratios

When assessing the financial performance of Brookfield Asset Management, it is essential to delve into its financial statements and key ratios. These metrics provide insights into the company’s profitability, efficiency, liquidity, and solvency. By analyzing these factors, you can gauge the financial health of Brookfield Asset Management and its ability to generate returns for its investors.

Starting with profitability, the company’s net profit margin is a significant indicator. This ratio reveals the percentage of revenue that translates into profit after deducting all expenses. A higher net profit margin signifies better profitability. It is crucial to compare this ratio with industry benchmarks to assess Brookfield Asset Management’s performance.

Furthermore, examining the return on equity (ROE) ratio provides insight into how effectively Brookfield Asset Management utilizes shareholders’ equity to generate returns. A higher ROE is generally favorable, indicating efficient utilization of resources.

The liquidity position of Brookfield Asset Management can be evaluated through the current ratio. This ratio measures the company’s ability to pay short-term obligations using its current assets. A ratio of greater than 1 indicates a favorable liquidity position.

Another essential aspect is the debt-to-equity ratio, which displays the company’s level of leverage. A higher debt-to-equity ratio may indicate higher financial risk. It is vital to compare this ratio with industry peers to assess Brookfield Asset Management’s solvency.

Furthermore, analyzing the company’s cash flow statement provides insights into its operating, investing, and financing activities. Cash flow from operations indicates the company’s ability to generate cash through its core business activities. Positive cash flow from operations is a positive sign for investors.

Comparison of the financial performance of Brookfield Asset Management with its competitors

To gain a comprehensive understanding of Brookfield Asset Management’s financial performance, it is crucial to compare it with its competitors in the industry. This analysis allows you to evaluate its position relative to its peers.

Key metrics to consider when comparing financial performance include revenue growth, profit margins, return on assets, and return on equity. By benchmarking Brookfield Asset Management against its competitors, you can identify its strengths and areas for improvement.

Additionally, analyzing the company’s financial stability and solvency compared to its competitors is vital. Factors such as debt levels, interest coverage ratios, and liquidity position provide insights into the company’s financial health and ability to weather economic downturns.

Moreover, understanding how Brookfield Asset Management’s investment strategies have contributed to its financial performance is crucial. This includes evaluating the impact of its diversified portfolio across different sectors and geographies on revenue and profitability. Additionally, assessing how the company’s long-term perspective and focus on real assets contribute to key financial metrics is essential.

In conclusion, reviewing Brookfield Asset Management’s financials and comparing its financial performance with its competitors provides valuable insights into the company’s profitability, efficiency, liquidity, and solvency. Assessing key ratios and benchmarking against industry peers allows investors to evaluate the company’s financial health and potential for generating returns. Moreover, analyzing the impact of Brookfield Asset Management’s investment strategies on financial performance helps understand the effectiveness of its approach. By considering these factors, you can make informed investment decisions and assess the company’s ability to deliver long-term value.

Sustainability and ESG Initiatives

Brookfield Asset Management’s commitment to sustainability

When it comes to sustainability, Brookfield Asset Management understands the importance of incorporating environmental, social, and governance (ESG) considerations into its business practices. The company recognizes that sustainable investing is not only beneficial for the planet but also contributes to long-term value creation for its investors.

Brookfield Asset Management is committed to minimizing the environmental impact of its operations. The company implements various strategies to reduce energy consumption, water usage, and greenhouse gas emissions across its global portfolio of real assets. By investing in energy-efficient technologies and renewable energy projects, Brookfield Asset Management aims to create a more sustainable future.

Furthermore, the company is dedicated to creating positive social impacts. Brookfield Asset Management believes in promoting diversity and inclusivity in its workforce, ensuring equal opportunities for all employees. The company actively supports community development initiatives and invests in projects that improve the social well-being of the communities in which it operates. By fostering strong relationships with stakeholders, Brookfield Asset Management aims to create shared value and contribute to social progress.

Environmental, social, and governance (ESG) initiatives undertaken by Brookfield Asset Management

Brookfield Asset Management has implemented several ESG initiatives to align its business activities with sustainability goals. These initiatives focus on three key areas: environmental impact, social responsibility, and sound governance practices.

On the environmental front, Brookfield Asset Management is committed to integrating sustainable practices throughout its operations. The company aims to reduce its carbon footprint by implementing energy-efficient measures, promoting renewable energy sources, and actively managing waste and water resources. By prioritizing environmental stewardship, Brookfield Asset Management ensures that its portfolio of real assets is resilient to climate change and supports the transition to a low-carbon economy.

In terms of social responsibility, Brookfield Asset Management recognizes the importance of supporting the communities in which it operates. The company engages with stakeholders to understand their needs, invests in local infrastructure projects, and supports job creation. By prioritizing social impact, Brookfield Asset Management aims to contribute to the long-term well-being of communities and enhance the quality of life for individuals.

Brookfield Asset Management also places strong emphasis on governance practices. The company adheres to high standards of transparency, accountability, and ethical conduct. It has implemented robust governance frameworks and risk management systems to ensure sound decision-making and protect the interests of its investors. By maintaining strong corporate governance practices, Brookfield Asset Management builds trust with its stakeholders and fosters a culture of responsible business conduct.

In conclusion, Brookfield Asset Management’s commitment to sustainability and its ESG initiatives demonstrate its dedication to creating long-term value for its investors while considering the broader social and environmental impacts of its operations. By prioritizing sustainable practices, the company strives to be a leader in sustainable investing and contribute to a more resilient and inclusive future. Through its efforts in environmental management, social responsibility, and governance, Brookfield Asset Management showcases its commitment to integrating sustainability into its business practices and making a positive difference in the world.