How does Brookfield Asset Management differentiate itself from competitors in the asset management industry?

Introduction

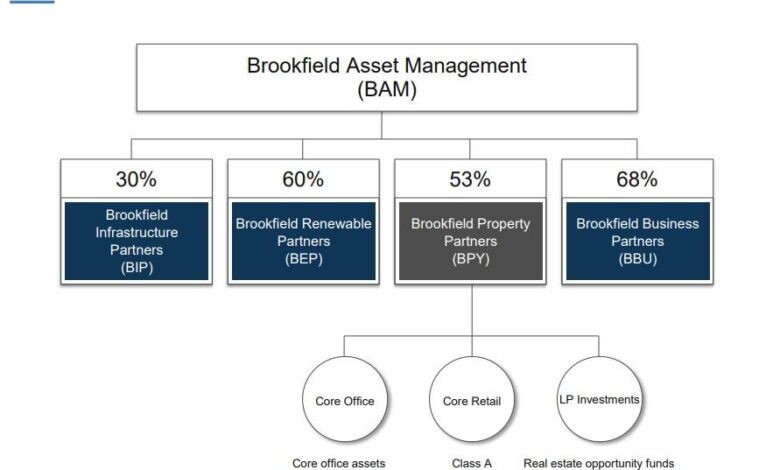

Brookfield Asset Management is a renowned global alternative asset manager with over $600 billion in assets under management. It operates across a broad range of industries, including real estate, infrastructure, renewable power, and private equity. In the fiercely competitive asset management industry, Brookfield has managed to differentiate itself from its competitors through several key strategies. This article will provide an overview of Brookfield Asset Management and the asset management industry, and then delve into how Brookfield has established its unique position in the market.

Overview of Brookfield Asset Management and the asset management industry

The asset management industry is highly competitive, with numerous players offering similar investment products and solutions to clients. However, Brookfield stands out in this crowded landscape. Established in 1899, the company has a long-standing track record of successful investments and value creation for its clients. Brookfield’s expertise in identifying and managing unique and non-traditional assets sets it apart from its competitors.

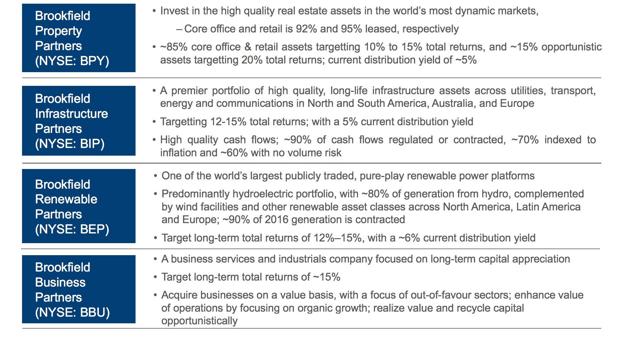

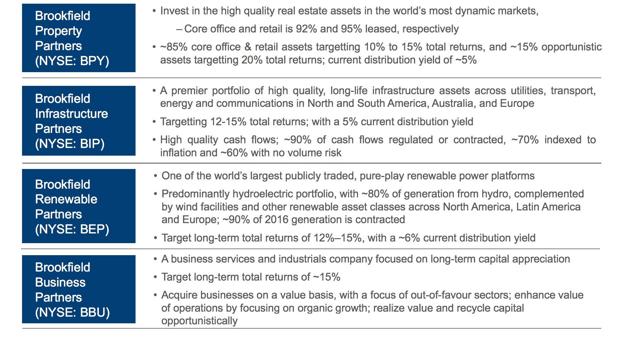

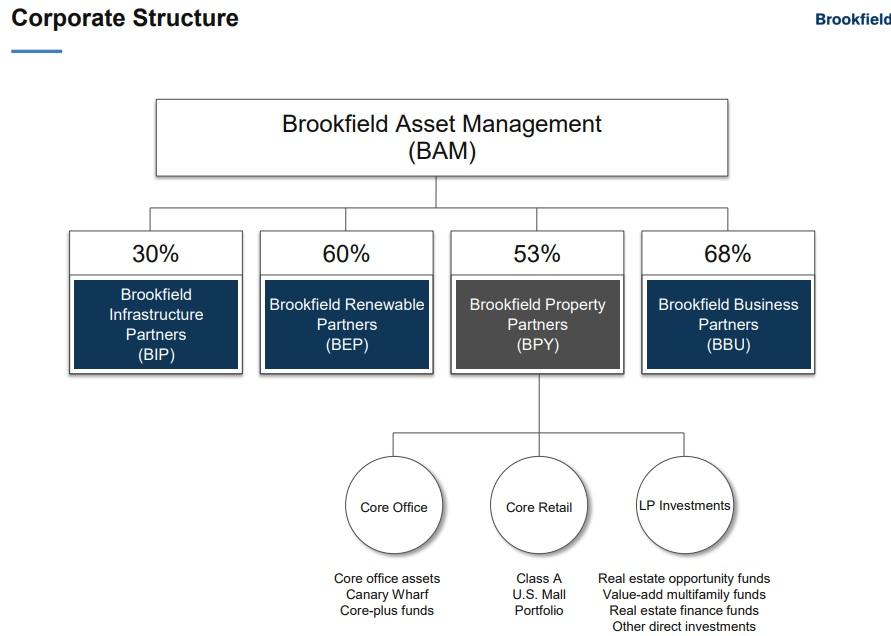

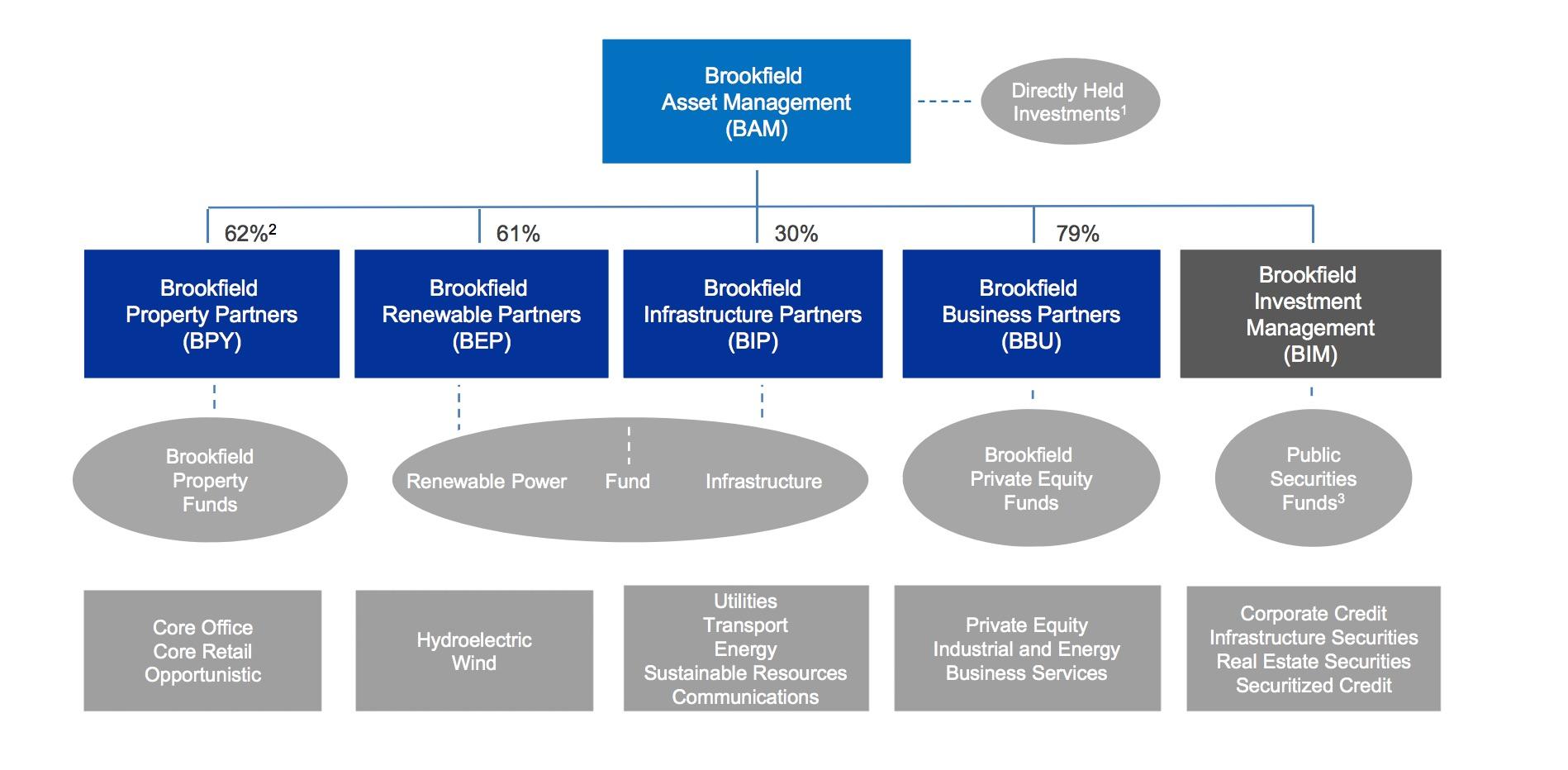

Brookfield focuses on alternative assets that have the potential for long-term value creation. These include real estate, infrastructure assets such as ports, toll roads, and pipelines, as well as renewable power generation. By concentrating on these alternative assets, Brookfield differentiates itself from traditional asset managers that primarily invest in public equities and fixed income.

Brookfield Asset Management’s unique position in the industry

- Global Reach and Diversification: Brookfield has a global presence, with extensive operations in North America, Europe, Asia, and South America. Its widespread geographic reach enables the company to access a diverse range of investment opportunities and mitigate risk through portfolio diversification. This global footprint sets Brookfield apart from many of its competitors, who may have a more limited presence in certain regions.

- Long-term Investment Focus: Brookfield takes a long-term investment approach, focusing on assets with the potential for value appreciation over time. This differs from some competitors who may prioritize short-term gains. By emphasizing long-term value creation, Brookfield positions itself as a trusted partner for investors seeking steady and sustainable growth.

- Operational Expertise and Value Creation: Brookfield’s success lies in its ability to actively manage and enhance the value of its asset portfolio. The company has a deep bench of experienced professionals who specialize in various industries and sectors. This operational expertise enables Brookfield to identify opportunities to improve the performance of its investments, whether through operational efficiencies, cost reductions, or strategic partnerships.

- Focus on Sustainability and ESG: Brookfield is committed to responsible investing and places a strong emphasis on sustainability and environmental, social, and governance (ESG) factors. The company seeks to create positive social and environmental impacts through its investments, which resonates with clients who prioritize sustainable and ethical practices. This focus on ESG sets Brookfield apart from competitors who may not prioritize these factors to the same extent.

- Strategic Partnerships and Collaborations: Brookfield actively seeks partnerships and collaborations with like-minded organizations to leverage their collective strengths. These partnerships enable the company to access new investment opportunities, share expertise, and expand its global network. By forging strategic alliances, Brookfield differentiates itself by tapping into unique synergies that benefit both the company and its clients.

Overall, Brookfield Asset Management sets itself apart from competitors in the asset management industry through its global reach, focus on alternative assets, long-term investment approach, operational expertise, sustainability focus, and strategic partnerships. These factors contribute to Brookfield’s strong track record and differentiate the company as a trusted and reliable partner for investors looking for unique and value-driven investment opportunities.

Global Presence

Expanding global footprint of Brookfield Asset Management

Brookfield Asset Management has established a strong global presence, which sets it apart from many of its competitors in the asset management industry. The company’s extensive operations and investments across multiple regions have allowed it to access a diverse range of investment opportunities and strategically position itself in key international markets.

One of the key drivers of Brookfield’s global expansion is its focus on alternative assets. While many traditional asset managers primarily invest in public equities and fixed income, Brookfield has differentiated itself by concentrating on alternative assets such as real estate, infrastructure, renewable power, and private equity. This investment strategy has allowed Brookfield to tap into unique opportunities and diversify its portfolio across different sectors and geographies.

Key international markets and investments

Brookfield’s global presence is evident in its extensive operations in North America, Europe, Asia, and South America. These regions offer a wide range of investment opportunities and have significant growth potential.

In North America, Brookfield has a strong foothold in the United States and Canada. The company has a diversified portfolio of real estate properties, infrastructure assets, and renewable power projects across various cities in North America. This includes iconic properties such as the Brookfield Place in New York City and the TD Canada Trust Tower in Toronto. Brookfield’s investments in North America have been instrumental in driving its growth and establishing its reputation as a leading asset manager in the region.

In Europe, Brookfield has made significant investments in key markets such as the United Kingdom, Germany, France, and Spain. The company’s focus on real estate and infrastructure assets has allowed it to capitalize on the strong demand for high-quality properties and sustainable infrastructure development in these markets. Notable investments include the Canary Wharf Group in London and the Center Parcs holiday resorts in Germany and France.

Asia is another important region for Brookfield’s global expansion. The company has made strategic investments in countries such as China, India, Japan, and Australia. These investments span across different sectors, including real estate, infrastructure, and renewable power. Brookfield’s presence in Asia has been driven by the region’s rapid economic growth, urbanization, and increasing demand for quality infrastructure and sustainable development.

South America is also a key focus for Brookfield, with investments in countries like Brazil, Chile, and Peru. The company has capitalized on the region’s rich natural resources and growing infrastructure needs. Brookfield’s investments in South America include hydroelectric power plants, toll roads, and logistics facilities.

Overall, Brookfield Asset Management’s expanding global footprint is a testament to its ability to identify and capitalize on investment opportunities in diverse markets. The company’s focus on alternative assets, its deep industry expertise, and strategic partnerships have allowed it to establish a strong presence in key international markets. Brookfield’s global reach positions it as a trusted and reliable partner for investors looking for unique and value-driven investment opportunities across the world.

Diverse Portfolio

When it comes to asset management, Brookfield Asset Management truly stands out from its competitors through its diverse portfolio of asset classes. This wide range of investments allows Brookfield to differentiate itself and provide unique opportunities for investors. Here, we will explore how Brookfield differentiates itself with its diverse portfolio and its investments in real estate, infrastructure, renewable energy, and private equity.

Brookfield Asset Management’s Wide Range of Asset Classes

Unlike many traditional asset management firms that focus primarily on public equities and fixed income, Brookfield takes a more innovative approach by diversifying its portfolio across various asset classes. This diversified approach reduces risk and provides investors with a range of investment opportunities.

One of the key asset classes in Brookfield’s portfolio is real estate. With a strong foothold in North America, Europe, Asia, and South America, Brookfield has invested in a wide range of commercial, residential, and industrial properties. Their portfolio includes iconic properties such as Brookfield Place in New York City and the Canary Wharf Group in London. This global presence in the real estate market allows Brookfield to capitalize on various property markets and generate significant returns for its investors.

Infrastructure is another asset class that sets Brookfield apart from its competitors. As the demand for infrastructure continues to grow, Brookfield has strategically invested in toll roads, airports, ports, and data centers around the world. Their infrastructure investments not only provide essential services to communities but also offer stable and long-term cash flows for investors.

In line with its commitment to sustainability, Brookfield has made substantial investments in renewable energy. The company owns and operates a diverse portfolio of hydroelectric, wind, solar, and biomass power generation facilities. These investments align with global efforts to shift towards renewable energy sources and help mitigate the impact of climate change.

Private equity is yet another area where Brookfield excels. Through its private equity investments, Brookfield acquires and manages companies in various industries, including manufacturing, technology, and financial services. This hands-on approach allows Brookfield to actively contribute to the growth and development of these companies, creating value for both investors and stakeholders.

Investments in Real Estate, Infrastructure, Renewable Energy, and Private Equity

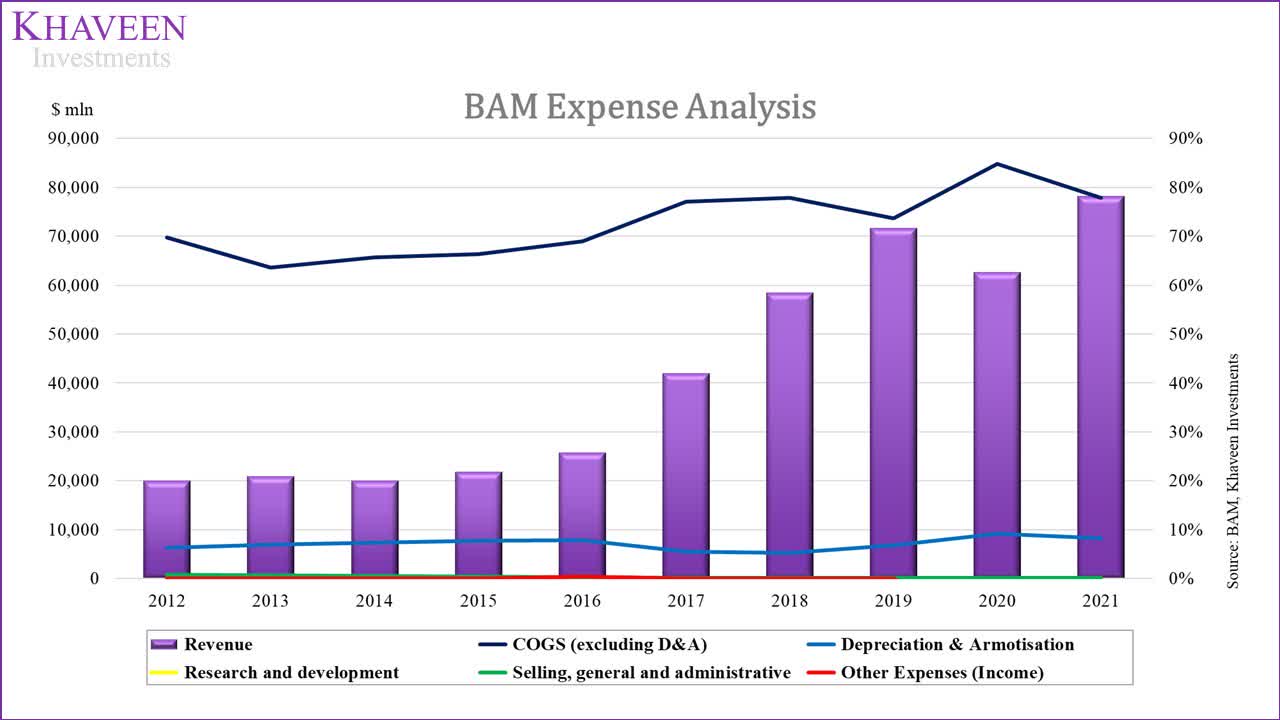

By investing in these different asset classes, Brookfield Asset Management is able to diversify its revenue streams and capture opportunities across multiple industries and geographies. This diversification not only spreads risk but also allows Brookfield to make informed investment decisions based on market trends and dynamics.

Furthermore, Brookfield’s deep industry expertise and extensive network of strategic partnerships set it apart in the asset management industry. The company’s knowledgeable teams have a deep understanding of each asset class and possess the skills necessary to identify and execute on attractive investment opportunities.

Brookfield’s differentiation also lies in its long-term investment horizon. Rather than focusing on short-term gains, the company takes a patient and disciplined approach, with the intention of maximizing value over the long term. This strategy has proven successful, as Brookfield has consistently delivered strong returns for its investors.

In conclusion, Brookfield Asset Management’s diverse portfolio of asset classes is a key factor that differentiates it from competitors in the asset management industry. Through its investments in real estate, infrastructure, renewable energy, and private equity, Brookfield offers investors a wide range of unique and value-driven opportunities. The company’s global presence, industry expertise, and long-term investment horizon make it a trusted partner for investors looking to diversify their portfolios and achieve sustainable returns.

Active Management Approach

When it comes to asset management, Brookfield Asset Management sets itself apart from competitors through its active management approach. This strategy encompasses a range of tactics and practices that differentiate Brookfield and add value to its investors. Here, we will explore Brookfield Asset Management’s active management strategy and how it utilizes operational expertise and a hands-on approach to deliver superior results.

Brookfield Asset Management’s Active Management Strategy

Active management is a core component of Brookfield Asset Management’s approach to asset management. Unlike passive investment strategies that aim to replicate market performance, active management involves actively making investment decisions to outperform the market. Brookfield’s team of experienced professionals continuously monitors and analyzes market trends, identifies investment opportunities, and makes informed decisions to optimize returns.

One way in which Brookfield implements its active management strategy is by actively managing its diverse portfolio of asset classes. By closely monitoring the performance of each investment, Brookfield is able to identify underperforming assets and take corrective actions to enhance returns. This proactive approach allows Brookfield to continuously optimize its portfolio and deliver superior results for its investors.

Adding Value through Operational Expertise and Hands-On Approach

One of the key ways in which Brookfield differentiates itself in the asset management industry is through its operational expertise and hands-on approach. Brookfield’s team of investment professionals possess deep industry knowledge and expertise in each asset class they manage. This expertise enables them to identify operational efficiencies, implement value-enhancing strategies, and improve the performance of portfolio companies.

In addition to operational expertise, Brookfield also takes a hands-on approach in managing its investments. Unlike passive managers who simply allocate capital to various assets, Brookfield actively engages with the companies it invests in to drive operational improvements and create value. This hands-on approach includes providing strategic guidance, implementing best practices, and leveraging synergies across its portfolio of companies.

Brookfield’s operational expertise and hands-on approach have been particularly evident in its real estate investments. Rather than being a passive property owner, Brookfield actively manages its properties to enhance their value. This may involve renovating and repositioning assets, improving operational efficiencies, or capitalizing on growth opportunities. By actively managing its real estate holdings, Brookfield is able to maximize returns and create value for its investors.

Another area where Brookfield’s operational expertise shines is in its infrastructure investments. The company’s team of professionals actively engages with governments, regulatory bodies, and industry experts to navigate complex infrastructure projects successfully. This includes managing construction projects, optimizing revenue generation, and ensuring the long-term viability of the infrastructure assets. By actively managing its infrastructure investments, Brookfield is able to generate stable and predictable cash flows for its investors.

Furthermore, Brookfield’s hands-on approach extends to its private equity investments. Rather than passively investing in companies, Brookfield actively partners with management teams to drive growth and operational improvements. This may involve implementing strategic initiatives, expanding into new markets, or leveraging Brookfield’s global network and resources. By actively managing its private equity investments, Brookfield is able to add value and create sustainable long-term growth.

In conclusion, Brookfield Asset Management differentiates itself from competitors in the asset management industry through its active management approach. By actively managing its diverse portfolio of asset classes, Brookfield consistently outperforms the market and delivers superior returns for its investors. The company’s operational expertise and hands-on approach enable it to identify opportunities, optimize performance, and create value in each investment. Whether it is through maximizing returns in real estate, driving operational improvements in infrastructure, or fueling growth in private equity, Brookfield’s active management approach is a key factor that sets it apart in the asset management industry.

Long-Term Investment Horizon

Focus on long-term value creation and sustainable growth

Brookfield Asset Management distinguishes itself from its competitors in the asset management industry by adopting a long-term investment horizon focused on creating sustainable growth and maximizing long-term value for its investors. While many competitors may prioritize short-term gains and quick returns, Brookfield takes a patient and strategic approach to investing.

Rather than jumping on short-term trends or attempting to time the market, Brookfield focuses on identifying high-quality assets and businesses with strong growth potential. The company seeks out investments that align with its long-term investment thesis and strategic goals. This approach allows Brookfield to avoid being swayed by short-term fluctuations in the market and instead focus on creating long-term value.

Brookfield’s commitment to long-term value creation is evident in its asset management strategy. The company takes a hands-on approach to managing its investments, actively engaging with portfolio companies to drive operational improvements and enhance value over time. This approach includes implementing strategic initiatives, optimizing operational efficiencies, and leveraging its global network and resources to fuel long-term growth.

By taking a holistic view of its investments and focusing on sustainable growth, Brookfield aims to deliver consistent and attractive risk-adjusted returns for its investors over the long term. This commitment to long-term value creation sets Brookfield apart from competitors who may prioritize short-term gains at the expense of sustainable growth.

Comparison to competitors’ short-term investment strategies

In contrast to Brookfield’s long-term investment horizon, many competitors in the asset management industry focus on short-term investment strategies aimed at generating quick returns. These strategies often involve chasing market trends, attempting to time the market, and taking advantage of short-term market inefficiencies.

While these strategies may yield short-term gains, they also come with higher risks and volatility. By constantly chasing short-term opportunities, investors may miss out on the benefits of long-term value creation and sustainable growth. Additionally, the volatile nature of short-term strategies can lead to inconsistent performance and higher transaction costs.

Brookfield’s approach, on the other hand, prioritizes stability, consistency, and long-term value creation. By taking a patient and strategic approach to investing, Brookfield aims to generate consistent and attractive risk-adjusted returns for its investors over the long term. The company’s focus on sustainable growth and value creation sets it apart from competitors who may be more focused on short-term gains and market timing.

Furthermore, Brookfield’s long-term investment horizon allows the company to take advantage of opportunities that may not be immediately apparent. By focusing on the long term, Brookfield can identify undervalued assets or businesses with significant growth potential that may not be recognized by the market in the short term. This contrarian approach can lead to attractive investment opportunities and higher potential returns over the long run.

In conclusion, Brookfield Asset Management differentiates itself from competitors in the asset management industry through its focus on a long-term investment horizon and commitment to creating sustainable growth and long-term value. By prioritizing stability, consistency, and strategic investing, Brookfield aims to deliver consistent and attractive risk-adjusted returns for its investors over the long term. In contrast to competitors who may prioritize short-term gains and market timing, Brookfield’s patient and strategic approach sets it apart in the asset management industry.